Tina

Says Tina, "I was kind of in a spot where I was like this is stupid, I’m never ever gonna get out of debt. I’ll never be able to buy a home, or buy anything. So it was around that time that I was going to Evergreen and I had an academic advisor who her background was in law. I asked her if she knew of anything out there that could kind of help me to get the interest taken off. Then I was given the ACLU interest waiver guide. It’s a guide on how to obtain a court order waiving or reducing interest on legal financial obligations. So I got this packet of stuff from her and I was still really nervous about doing it and then I was finally like screw it, what do you have to lose? Either they are going to say yes, or they are gonna say no."

"Oh my gosh, I wanted to scream and jump for joy in the courthouse. . . . It's a work in progress. There is light at the end of the tunnel."

~ Tina

That's how Tina felt when the judge granted her motion requesting a waiver of the 12% interest that had accrued on her LFO debt, now totalling $50,000. Tina filed the motion to waive or reduce the interest on her LFOs, after paying $325 per month for two years.

Tina filed the motion on her own, without the assistance of counsel. The first time she didn't do it correctly. The second time the judge granted her motion, removing $22,859.52 in interest and collection agency fees, leaving her owing $16,388.50. The debt "was causing significant hardship for me and my family and preventing me from being able to succeed and be debt free." She also filed a motion on behalf of her husband and got his interest waived as well.

Tina is now a chemical dependency counselor after serving time in prison for several drug offenses. She and her husband pay $200 per month towards their LFO debt.

IN TINA'S OWN WORDS . . .

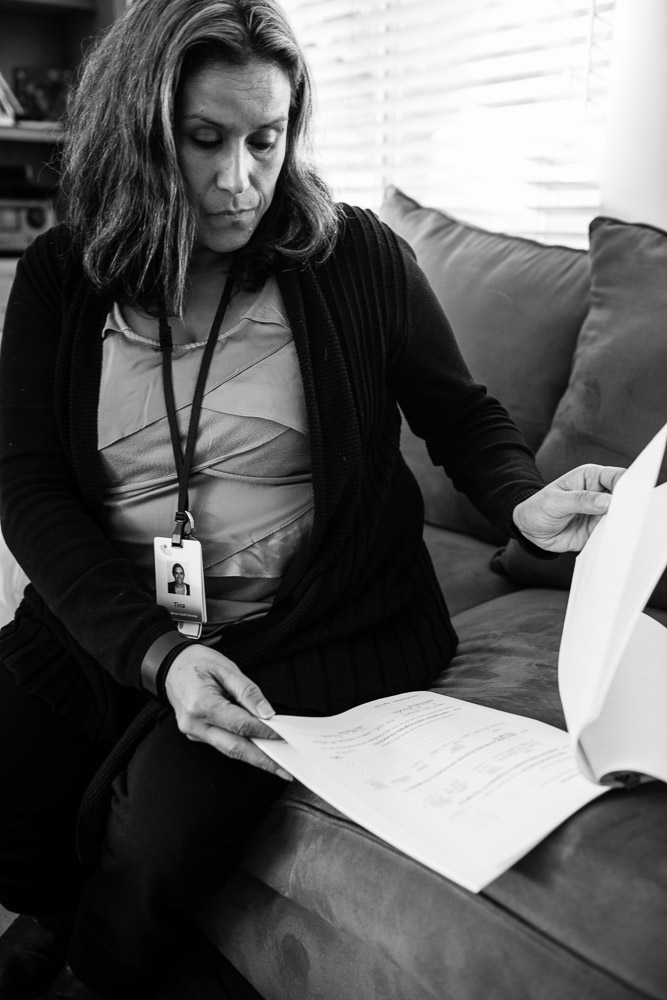

Tina reviewing her motion to waive interest on her LFOs.

On Legal Financial Obligations . . .

"For those of us who have done things that we are not particularly proud of, due to addiction, whatever the reason it is that causes somebody to be led down that path, we served our time. And we’ve completed that sentence. It’s very unfair to keep us kind of trapped under this thumb of the law.

I understand that we should be responsible for paying the attorney that we had to have for the courts and those other costs that are involved but to add all of this interest and these other fees and all of that stuff still accumulating, you get people trapped into this mindset that it’s never gonna get better, it’s never gonna change Why am I even gonna try to attempt to do good because it's not gonna make a difference? I’m still gonna stay stuck in this situation.

Give people a chance to turn their lives around. And do something better and not keep us financially pinned down to the point where it's better off that they continue to break the law and live a lifestyle where they can have an income that’s under the table. If you want us to be productive members of society, then we need to be given that chance to be able to do that without having all of this other hardship and financial burden that gets attached because a lot of us cannot even get really good jobs that pay well to be able to pay stuff off because we now have a criminal history."